Individuals with business source. Deadline for Malaysia Income Tax Submission in 2022 for 2021 calendar year 1.

Pin On Google Seo Digital Marketing Performance Report

Manually to Tax Information Record Management Division LHDNM.

. Return Forms can be submitted by two 2 methods. First thing first. Beginning year of assessment 2020 a company has to self assess income tax payable and submit the declaration to LHDN using.

Hence when you file your income tax and include your bank account details it will enable the Inland Revenue Board Malaysia IRBM to deposit your tax refund directly into your. Tax payable under an assessment upon submission of a tax return is due and payable by the last day of the seventh month from the date of closing of accounts. Individuals without business source.

Annual income statement prepared by company to employees for tax submission. Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di cawangan-cawangan LHDNM. Online via Customer Feedback Forms at.

1 Self Assessment System SAS is based on the concept of Pay Self Assess and File. 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

How to submit your ITRF. On or before 30 April every year. Taxpayers can start submitting their income tax return forms through the e-Filing system starting from March 1 of every year unless otherwise announced by LHDN.

Beginning year of assessment 2020 a company has to self assess income tax payable and submit the declaration to LHDN using. You must first go to httpsedaftarhasilgovmy and then click on the Daftar Individu button if you have never submitted your taxes before on the e-Filing income tax. Headquarters of Inland Revenue Board Of Malaysia.

Paying income tax due. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Form C refers to income tax return for companies.

Form C refers to income tax return for companies. Online submission via MyTax at httpsmytaxhasilgovmy. E-Filing Pin number request.

Microsoft Windows 81 service pack terkini Linux atau. Kindly refer guide notes explanatory notes which can be. Hak Cipta Terpelihara 2022 Lembaga Hasil Dalam Negeri Malaysia.

Introduction Individual Income Tax. Submission of tax estimate in Malaysia is mandatory under Section 107C of the Malaysian Income Tax Act 1967. MyTax - Gerbang Informasi Percukaian.

Visit your nearest IRB branch if you need help to complete your income tax return form or call the Hasil Care Line at the hotline 03-89111000 603-89111100 Overseas. The prescribed form for initial submission is Form CP204. The due date for submission of Income Tax Return.

For the BE form resident individuals who do not carry on business the. Below are steps to activate MyTax account. Self assessment means that taxpayer is required by law to determine his taxable income compute.

The IRB has published on its website the 2022 income tax return filing programme 2022 filing programme titled Return Form RF Filing Programme For The Year 2022 dated.

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Como Economizar Dinheiro Simbolo De Libra Graficos Financeiros

Orisoft Is The More Famous Software Company In Malaysia To Get These Services Easily Like Human Resource Software Hr Management Payroll Software Management

Individual Income Tax In Malaysia For Expatriates

Create The Perfect Design By Customizing Easy To Use Templates In Minutes Easily Convert Your Image Designs Into Vid Tax Preparation Tax Refund Tax Consulting

How To Calculate Income Tax In Excel

Watch This Before Filing Income Tax 2022 Pt 1 Complete Guide To File Tax Returns In Malaysia Youtube

How To Calculate Income Tax In Excel

How Much Do You Need To Save For Your Children S Higher Education Created In Free Piktochart Infogra Educational Infographic Childrens Education Education

What Is Local Income Tax Types States With Local Income Tax More

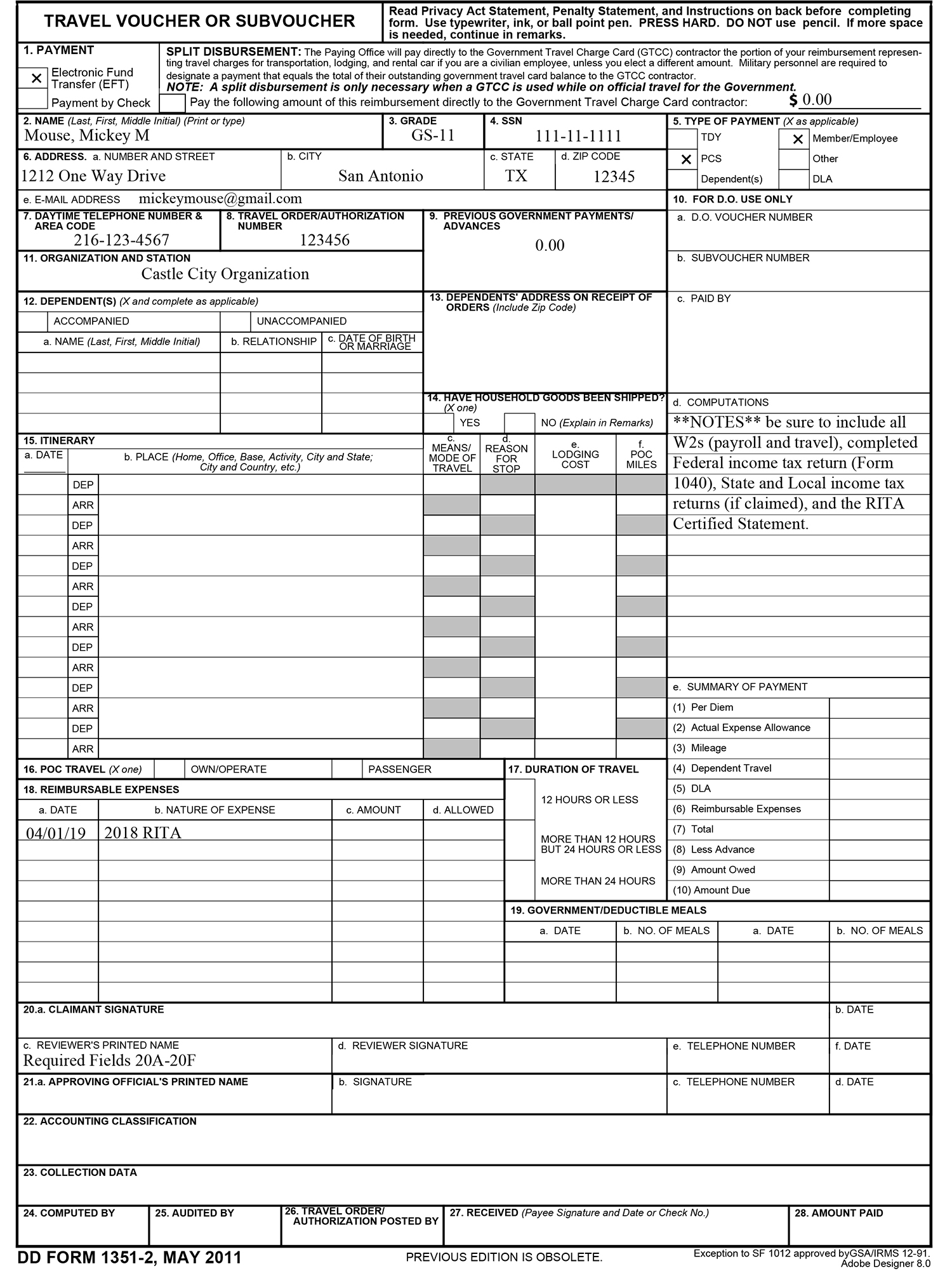

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Online Gst Accounting Software Made Easy Affordable For Smes Accounting Software Accounting Tax Services

Priyankamadan I Will Prepare Usa Income Tax Return For Corporates For 50 On Fiverr Com Income Tax Return Tax Return Tax Consulting

Do You Need Help Filing Your Income Tax Returns Get Help From An Expert Taxithere Helps To File Your Income Tax Return Filing Taxes Tax Services Online Taxes

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

How To Calculate Income Tax In Excel

Tax Compliance Calendar For Fy 2019 20 It Gst Tds Eztax In Compliance Income Tax Return Sme Business

Notice From Gst Department Top Reasons Response Timing Eztax In Accounting Tax Services Accounting Software

Cheap And Effective Web Hosting Solutions Tax Deadline Types Of Taxes Self Assessment